Our Services

Financial Planning Software

At Harriman Financial, we focus on a consultative approach to financial planning rather than the industry transactional sales approach. Our approach is Needs-based planning, which allows clients to align their money and life with their values and goals.

Needs-based planning is a long-term relationship of mutual respect where we seek the result of a happier and more loyal client and a more prosperous and emotionally gratifying business for the financial professional. This philosophy is the most ethical and client-centered method for building high-trust client relationships and spurs our clients to follow through with achieving their goals.

A centerpiece of this philosophy is our proprietary financial planning software, the MoneyEdge®. This needs analysis software helps advisors develop financial strategies for their clients. The program is 100% web-based and examines the client’s financial position and identifies their retirement and other goals to create and implement financial strategies.

Click here to see an example of what a sample MoneyEdge looks like.

Investment Management

Stocks, Bonds, Mutual Funds, Annuities, Alternative Investments, and more. Which is right for you? Everyone is different, with varying time horizons, risk tolerances, and objectives. As independent advisors fully licensed, we have access to many available investment options to benefit our clients.

While new investors may choose a diversified low-cost mutual fund portfolio, more seasoned investors with larger asset bases may prefer a fee-based solution with many investment components. Or a combination of both strategies may be the optimal solution. We work with each client to build an asset management solution to fit your individual goals.

A word to those with high net worth and/or high income – We go above and beyond the average firm as we work with our accredited investors to utilize tax mitigation strategies, reduce risk, and seek returns in non-market correlated arenas, such as:

- Energy Development investments with significant current and subsequent year tax advantages.

- Qualified Opportunity Zones and Income Producing Properties

- Preferred Stock strategies and other income generating solutions.

- Hedging strategies to mitigate market risk.

- And more!

Risk Analysis

We prioritize managing risk because we understand that while return on investment matters, so does the stability of your financial plan. Our focus extends beyond just returns; it’s about ensuring that the solutions we offer align with your risk tolerance, increasing the likelihood of your long-term commitment to the plan.

Utilizing cutting-edge risk analysis software, we assess various outcomes and analyze portfolios to match them with your acceptable risk range. Assigning risk numbers from 1 to 99 to both your profile and portfolios simplifies comparisons, aiding in aligning your risk tolerance with portfolio risk. Moreover, our system generates an investment policy statement, documenting these details for future reference.

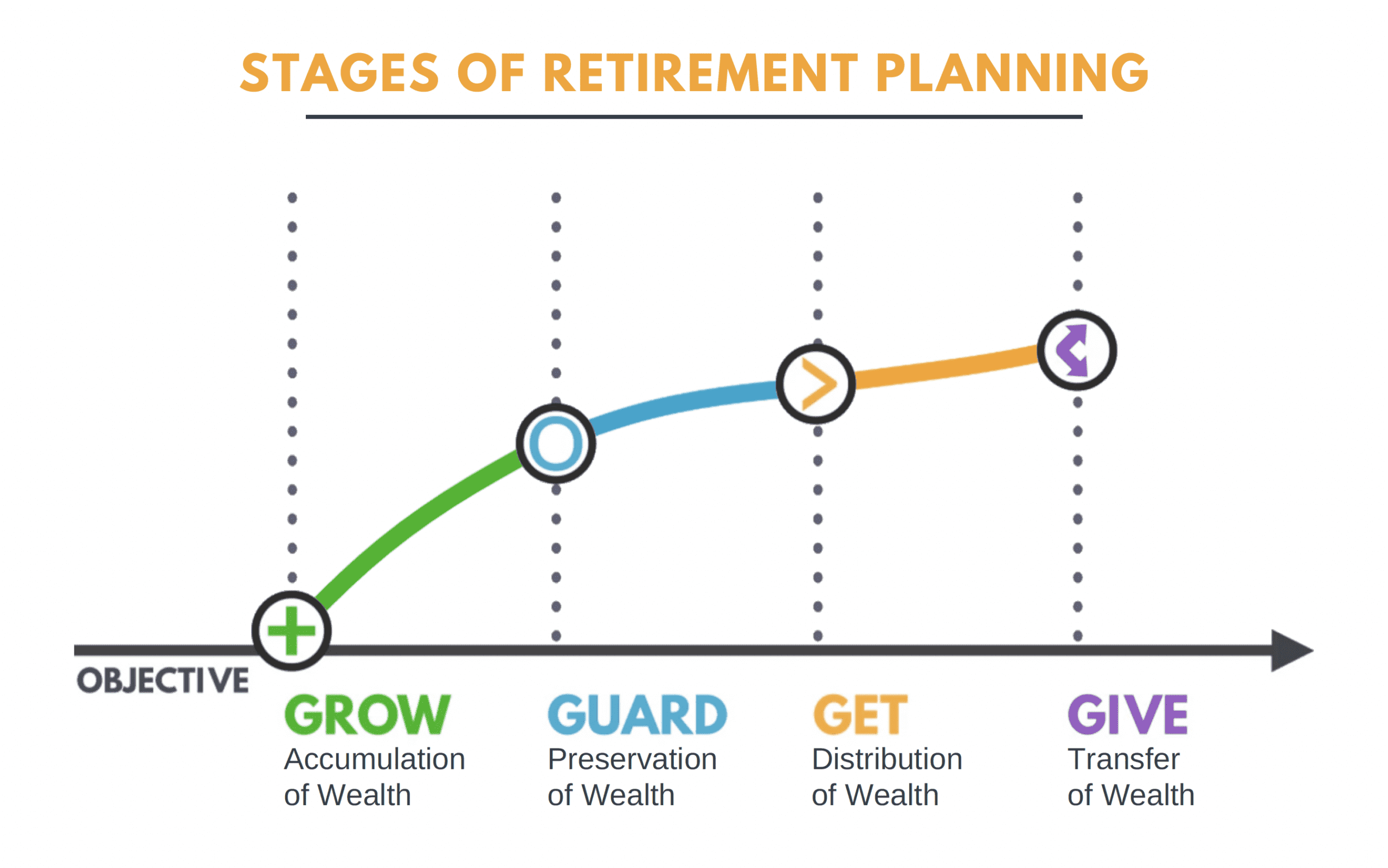

4G Advisory Portfolios

Your financial journey will likely include four stages of retirement planning: Grow, Guard, Get, and Give. The 4G Advisory Portfolios are based on the goals of each stage and address their unique demands. With the 4G Advisory Portfolios, your investments will be actively managed by a team of fiduciaries, which means they are required to act in your best interest. Let the 4G Advisory Portfolios help you accumulate, preserve, distribute, and eventually transfer your wealth to others.

Have a Question?

Please contact our office and schedule a time with one of our friendly, capable advisers today.